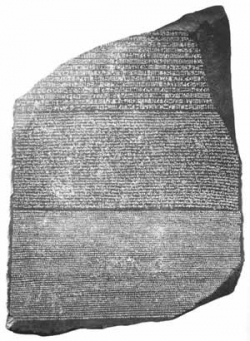

Reviewing term sheets from investors can be time consuming and not a little confusing, especially for first time entrepreneurs who may have never seen one before. That puts them at a disadvantage against the investor. Across Europe, the picture is even more confusing. What we needed was a sort of Rosetta Stone term sheet. So today a group of 21 early European stage investors have decided, under the SeedSummit umbrella group, to standardise on two “reader-friendly” term sheet templates. One is being dubbed the SeedSummit Term Sheet and the other an Enterprise Investment Scheme (EIS) friendly variant, tailored for the UK market. See here. This is the first time European investors have co-operated in this way, on this scale.

Reviewing term sheets from investors can be time consuming and not a little confusing, especially for first time entrepreneurs who may have never seen one before. That puts them at a disadvantage against the investor. Across Europe, the picture is even more confusing. What we needed was a sort of Rosetta Stone term sheet. So today a group of 21 early European stage investors have decided, under the SeedSummit umbrella group, to standardise on two “reader-friendly” term sheet templates. One is being dubbed the SeedSummit Term Sheet and the other an Enterprise Investment Scheme (EIS) friendly variant, tailored for the UK market. See here. This is the first time European investors have co-operated in this way, on this scale.

SeedSummit, a 50+ group which convened first in 2009, hopes that the benefits to startups will include reducing the time it takes to get deals done, reducing legal costs and greater transparency. They were inspired, they say, by the Series Seed docs of the USA.

The participants in the initiative consist of some of the leading early stage and Seed investors in Europe:

360 Capital

ACT Ventures

Charlotte Street Capital

Doughty Hanson Technology Ventures

Earlybird

Eden Ventures

Estag Capital

GIMV

Henq

Index SeedKima Ventures

Kima Ventures

Nesta

Northzone

Notion Capital

Passion Capital

Point Nine Capital

ProFounders Capital

Samos Investments

Seedcamp

Venrex Investment Management

Wellington Partners

These stretch across the UK, Germany, France, Israel and Scandinavia, amongst many others.

In a statement SeedSummit said: “We hope these documents help bring coherence to the fragmentation of the european market. By bringing the players to reach a common agreement for the benefit of the entrepreneur we hope to save entrepreneurs time and money and to ensure that the limited funds they are raising are used for the most important thing: building product for their customers. Our Group of partners are actively investing across UK, Germany, France, Israel, Ireland, Scandinavia amongst many others, but we would love to have many more partners globally join our initiative.”

Investor Christoph Janz of Point Nine Capital told me: “The SeedSummit term sheet will bring more transparency to the market – if a founder receives a term sheet from an investor he can check it against the SeedSummit template (and check if that 3x participating liquidation preference with 12% cumulative dividend is really “standard” – which it’s not!”

It’s a good idea, although it’s been a while coming. I heard tell of this being discussed way back in Dec 2009 and again this year, so it’s a shame it’s taken quite this long. Indeed, even little old Finland got it’s act together with it’s SeriesSeed.fi back in February. Passion Capital published its own term sheet three months ago. And StartupBootcamp just yesterday published their contracts on their blog.

However, getting 15 investors to agree on standard documents is no mean feat and takes time.

An additional question is why standardise on UK docs, when so many of the parties involved operate in home territories, like Tel Aviv, Germany etc?

Carlos Espinal, partner in Seedcamp and one of those leading SeedSummit, told me: “Clearly if we are to simplify things [for entrepreneurs across Europe], we have to start somewhere. These term sheets could precede more legally complicated ones for specific jurisdictions – so this is a guideline for any local use.”

In other words, if this initiative is to work, entrepreneurs should consider these simplified terms first, before negotiations get deeper. One point though: We understand law firm Brown Rudnick in the UK, which usually works with investors, consulted on the drafting of the docs. This is great but it would be helpful if a law firm which usually represents startups also looked over the documents.

So who benefits?

As Seedcamp’s Reshma Sohoni put it to me: “Other startups in Europe are getting screwed. At least now we can say here are a bunch of active Western European investors given their stamp of approval to these documents. It means less confusion. It’s not just a UK thing – it’s about building trust between borders. It’s going to be easier to do deals across borders.”

Is this something to do with the ‘bubble’? Are they feeling heat from the accelerators? Do they need to up their PR game?

Our sources say not, although the explosion of accelerators, increased industry transparency and the rise of sites like AngelList have all raised the heat in the game.

However, it’s worth noting that there is no accelerator so far on board with this initiative. I asked StartupBootcamp and Springboard in the UK if they were invited to participate – they were not. SeedSummit told me they “hope they can join” the initiative soon.

At any rate, this initiative is to be welcomed in reducing the confusion in the patchwork European eco-system.

As Ivan Farneti of Doughty Hanson.com emailed me this salient comment: “There I still a lot of asymmetry of knowledge between investors and entrepreneurs. What is a standard term? What is considered normal and generally acceptable in this industry? In the southern part of Europe a lot of offers (as many as 2 out of 3) fall to the wayside because of misunderstandings, lack of knowledge and suspicion (sometimes compounded by the advice of “family” lawyers who have never done a venture deal before). This is a first step to help entrepreneurs raise capital from the investors in the industry. Also, the legal cost of early stage deals is disproportionate compared to the size of the money raised. We wish more of that cash to get into the business.”